Read entire report here.

Study Abstract:

There can be little doubt that the wealthiest Americans exert more political influence than the less affluent do. But there has been little systematic evidence about precisely what sorts of public policies the wealthy want government to pursue, or how the policy preferences of wealthy Americans resemble or differ from the preferences of ordinary citizens.

Data from our recently completed SESA (Survey of Economically Successful Americans and the Common Good) pilot study indicate that the top 1% or so of U.S. wealth-holders differ rather sharply from the American public over a number of important policies concerning taxation, economic regulation, and especially social welfare programs.

The more rarified, top 1/10th of 1% or so of wealth-holders (people with $40 million or more in net worth) appear on the average to hold still more conservative views – views that are even more distinct from those of the general public.

We suggest that these distinctive policy preferences may help account for why several types of public policies in the United States appear to deviate markedly from what the average U.S. citizen wants government to do. We discuss the implications of our findings for democratic theory.

Findings begin on page 8.

Authors:

Benjamin I. Page

Northwestern University

b-page@northwestern.edu

Larry M. Bartels

Vanderbilt University

larry.bartels@vanderbilt.edu

Jason Seawright

Northwestern University

j-seawright@northwestern.edu

For presentation at the annual meetings of the American Political Science Association,

Seattle, Washington, Aug. 31-Sept. 4, 2011 REVISED 9/29/11

Contact: 318.751.8540/dbedesigns@gmail.com

Sunday, September 23, 2012

Democracy and the Policy Preferences of Wealthy Americans: A Study

Labels:

1%,

Americans,

conservative,

democracy,

economic,

issues,

Policy,

political,

preferences,

science,

SESA,

social,

taxation,

taxes,

wealthy,

welfare

Sunday, September 16, 2012

Why Pink is for Girls Only

“It’s only been within the last 50 years or so that it’s really come

down hard on ‘Pink is for girls,” (author Lynn) Peril says.

“Even in the late ’50s, pink was a fashion color that was for men or for women. So you had Elvis wearing awesome pink shirts and pink suits and driving a pink Cadillac, because pink is the ‘it’ color of 1955. It’s probably not until after that people started getting into the idea that pink is ‘for girls only.’ And now that’s the only thing that it means, right?”

Peril says this particular version of “femininity” was borne out of the end of World War II.

“After the war, you had this huge rush of consumerism, and the economy was just humming along,” she says. “But returning vets needed jobs. So middle-class women—who had worked in factories during the war—were being not-so-gently prodded to focus on their roles as homemakers and wives. And manufacturers were willing to give them all kinds of new products to make them happy in the home, whether it was washers and dryers or beautiful pink Princess phones.”

Pink Think seems to have re-emerged in the new millennium with the popularity of the Disney Princess line for little girls and even “pinkified” products for adults like tool kits and ballpoint pens.

Feminist writer Lynn Peril, the author of Pink Think: Becoming a Woman in Many Uneasy Lessons, explains that mid-century manufacturers realized that if you take an ordinary object, turn it pink and put the word “Lady” in front of the name, then you’ve created a product “for women” that can be sold for more money. Peril coined the term “Pink Think” to describe this particular phenomenon, which she defines as “a group-think about what constitutes ‘proper’ female behavior.”

Read entire article here.

“Even in the late ’50s, pink was a fashion color that was for men or for women. So you had Elvis wearing awesome pink shirts and pink suits and driving a pink Cadillac, because pink is the ‘it’ color of 1955. It’s probably not until after that people started getting into the idea that pink is ‘for girls only.’ And now that’s the only thing that it means, right?”

Peril says this particular version of “femininity” was borne out of the end of World War II.

“After the war, you had this huge rush of consumerism, and the economy was just humming along,” she says. “But returning vets needed jobs. So middle-class women—who had worked in factories during the war—were being not-so-gently prodded to focus on their roles as homemakers and wives. And manufacturers were willing to give them all kinds of new products to make them happy in the home, whether it was washers and dryers or beautiful pink Princess phones.”

Pink Think seems to have re-emerged in the new millennium with the popularity of the Disney Princess line for little girls and even “pinkified” products for adults like tool kits and ballpoint pens.

Feminist writer Lynn Peril, the author of Pink Think: Becoming a Woman in Many Uneasy Lessons, explains that mid-century manufacturers realized that if you take an ordinary object, turn it pink and put the word “Lady” in front of the name, then you’ve created a product “for women” that can be sold for more money. Peril coined the term “Pink Think” to describe this particular phenomenon, which she defines as “a group-think about what constitutes ‘proper’ female behavior.”

Read entire article here.

Friday, September 14, 2012

Free Photo ID's for Louisiana Voters!!

Charlene Menard, the registrar of voters for Lafayette Parish, said Office of Motor Vehicles locations will provide any Louisiana resident with a free photo ID in order to vote.

You may get a free Louisiana Special ID at the Office of Motor Vehicles by showing your voter registration information card.

If you have misplaced your voter registration information card, contact your registrar of voters for a new one.

Voters who have no picture ID may bring a utility bill, payroll check or government document that includes their name and address.

Source: http://www.theadvertiser.com/article/20120911/NEWS01/209110331/Louisiana-s-voter-ID-compromise?nclick_check=1

You may get a free Louisiana Special ID at the Office of Motor Vehicles by showing your voter registration information card.

If you have misplaced your voter registration information card, contact your registrar of voters for a new one.

Voters who have no picture ID may bring a utility bill, payroll check or government document that includes their name and address.

Source: http://www.theadvertiser.com/article/20120911/NEWS01/209110331/Louisiana-s-voter-ID-compromise?nclick_check=1

Labels:

department,

DMV,

fraud,

free,

ID,

identification,

law,

Louisiana,

motor,

photo,

requirement,

resident,

vehicles,

vote,

voter,

where

Monday, September 10, 2012

10 Questions to Help Determine if Your Religious Liberty Is Being Threatened

|

| St. Louis Cathedral in New Orleans, LA by DBE |

It

seems like this election season "religious liberty" is a hot topic.

Rumors of its demise are all around, as are politicians who want to make

sure that you know they will never do anything to intrude upon it.

I'm a religious person with a lifelong passion for civil rights, so this is of great interest to me. So much so, that I believe we all need to determine whether our religious liberties are indeed at risk.

So, as a public service, I've come up with this little quiz. I call it "How to Determine if Your Religious Liberty Is Being Threatened in Just 10 Quick Questions."

Just pick "A" or "B" for each question.

1. My religious liberty is at risk because:

A) I am not allowed to go to a religious service of my own choosing.

B) Others are allowed to go to religious services of their own choosing.

2. My religious liberty is at risk because:

A) I am not allowed to marry the person I love legally, even though my religious community blesses my marriage.

B) Some states refuse to enforce my own particular religious beliefs on marriage on those two guys in line down at the courthouse.

3. My religious liberty is at risk because:

A) I am being forced to use birth control.

B) I am unable to force others to not use birth control.

4. My religious liberty is at risk because:

A) I am not allowed to pray privately.

B) I am not allowed to force others to pray the prayers of my faith publicly.

5. My religious liberty is at risk because:

A) Being a member of my faith means that I can be bullied without legal recourse.

B) I am no longer allowed to use my faith to bully gay kids with impunity.

6. My religious liberty is at risk because:

A) I am not allowed to purchase, read or possess religious books or material.

B) Others are allowed to have access books, movies and websites that I do not like.

7. My religious liberty is at risk because:

A) My religious group is not allowed equal protection under the establishment clause.

B) My religious group is not allowed to use public funds, buildings and resources as we would like, for whatever purposes we might like.

8. My religious liberty is at risk because:

A) Another religious group has been declared the official faith of my country.

B) My own religious group is not given status as the official faith of my country.

9. My religious liberty is at risk because:

A) My religious community is not allowed to build a house of worship in my community.

B) A religious community I do not like wants to build a house of worship in my community.

10. My religious liberty is at risk because:

A) I am not allowed to teach my children the creation stories of our faith at home.

B) Public school science classes are teaching science.

Scoring key:

If you answered "A" to any question, then perhaps your religious liberty is indeed at stake. You and your faith group have every right to now advocate for equal protection under the law. But just remember this one little, constitutional, concept: this means you can fight for your equality -- not your superiority.

If you answered "B" to any question, then not only is your religious liberty not at stake, but there is a strong chance that you are oppressing the religious liberties of others. This is the point where I would invite you to refer back to the tenets of your faith, especially the ones about your neighbors.

In closing, no matter what soundbites you hear this election year, remember this: Religious liberty is never secured by a campaign of religious superiority. The only way to ensure your own religious liberty remains strong is by advocating for the religious liberty of all, including those with whom you may passionately disagree. Because they deserve the same rights as you. Nothing more. Nothing less.

I'm a religious person with a lifelong passion for civil rights, so this is of great interest to me. So much so, that I believe we all need to determine whether our religious liberties are indeed at risk.

So, as a public service, I've come up with this little quiz. I call it "How to Determine if Your Religious Liberty Is Being Threatened in Just 10 Quick Questions."

Just pick "A" or "B" for each question.

1. My religious liberty is at risk because:

A) I am not allowed to go to a religious service of my own choosing.

B) Others are allowed to go to religious services of their own choosing.

2. My religious liberty is at risk because:

A) I am not allowed to marry the person I love legally, even though my religious community blesses my marriage.

B) Some states refuse to enforce my own particular religious beliefs on marriage on those two guys in line down at the courthouse.

3. My religious liberty is at risk because:

A) I am being forced to use birth control.

B) I am unable to force others to not use birth control.

4. My religious liberty is at risk because:

A) I am not allowed to pray privately.

B) I am not allowed to force others to pray the prayers of my faith publicly.

5. My religious liberty is at risk because:

A) Being a member of my faith means that I can be bullied without legal recourse.

B) I am no longer allowed to use my faith to bully gay kids with impunity.

6. My religious liberty is at risk because:

A) I am not allowed to purchase, read or possess religious books or material.

B) Others are allowed to have access books, movies and websites that I do not like.

7. My religious liberty is at risk because:

A) My religious group is not allowed equal protection under the establishment clause.

B) My religious group is not allowed to use public funds, buildings and resources as we would like, for whatever purposes we might like.

8. My religious liberty is at risk because:

A) Another religious group has been declared the official faith of my country.

B) My own religious group is not given status as the official faith of my country.

9. My religious liberty is at risk because:

A) My religious community is not allowed to build a house of worship in my community.

B) A religious community I do not like wants to build a house of worship in my community.

10. My religious liberty is at risk because:

A) I am not allowed to teach my children the creation stories of our faith at home.

B) Public school science classes are teaching science.

Scoring key:

If you answered "A" to any question, then perhaps your religious liberty is indeed at stake. You and your faith group have every right to now advocate for equal protection under the law. But just remember this one little, constitutional, concept: this means you can fight for your equality -- not your superiority.

If you answered "B" to any question, then not only is your religious liberty not at stake, but there is a strong chance that you are oppressing the religious liberties of others. This is the point where I would invite you to refer back to the tenets of your faith, especially the ones about your neighbors.

In closing, no matter what soundbites you hear this election year, remember this: Religious liberty is never secured by a campaign of religious superiority. The only way to ensure your own religious liberty remains strong is by advocating for the religious liberty of all, including those with whom you may passionately disagree. Because they deserve the same rights as you. Nothing more. Nothing less.

The Rev. Emily C. Heath is an ordained minister in the United Church of Christ (UCC) who serves as a local church pastor in southern Vermont. She is also a former hospital and hospice chapain, and a current chaplain to a fire department. She is a graduate of Emory University and Columbia Theological Seminary.

Louisiana: 49th among all fifty states in litigation fairness

|

| Art installation "Judge Not" dedicated to the officers of the court who stole my children: Woodrow "Woody" Nesbitt, Ron Miciotto, Charles "Pete" Kammer III, Shelley Booker (LCSW), and Judges Frances J. Pitman & Robert P. Waddell of the 1st Judicial Court in Caddo Parish, LA |

Louisiana's Overall Ranking: 49

Judges' Impartiality: 48

Judges' Competence: 48

Timeliness of Summary Judgment or Dismissal: 50

Discovery: 46

Scientific and Technical Evidence: 49

Juries’ Fairness: 48

(Source: US Chamber of Commerce — 2012 State Liability Systems Ranking Study/Sept. 10, 2012)

- The ranking marks Louisiana’s third consecutive year in that position and the state has never ranked higher than 47 since the survey’s inception in 2002.

- Seven in 10 business leaders say lawsuit climate ‘significant factor’ in determining where to expand & grow.

- “...Louisiana is still notorious for excessive verdicts, loose class-certification standards, and an unfair judiciary,” said Lisa A. Rickard, president of the U.S. Chamber Institute for Legal Reform.

- According to the study, Creating Conditions for Economic Growth: The Role of the Legal Environment, completed for ILR by NERA Economic Consulting in 2011, Louisiana could save up to $1.1 billion in tort costs and increase employment between 1.03 – 2.79% by improving its legal environment.

See the entire 50-state list and read a full copy of Lawsuit Climate 2012: Ranking the States online at: www.instituteforlegalreform.com/states

(Source: USCOfC Institute for Legal Reform. ILR seeks to promote civil justice reform through legislative, political, judicial, and educational activities at the national, state, and local levels. Contact: Mike Lepage @ 202-463-5554.)

Labels:

49th,

attorneys,

bad lawyers,

climate,

corruption,

judges,

justice,

legal,

litigation,

Louisiana,

Pete Kammer,

rank,

report,

Ron Miciotto,

Shelley Booker,

system,

unfair,

unjust,

Woody Nesbitt,

worst

Tuesday, September 4, 2012

The Art of Political Navigation

"The rowers on the left are frantically giving one-directional force, while the right-side rowers are trying to steer in the opposite direction. It’s practically a full-time job just to keep a score card of whopping fibs (LIES!) that come out of some mouths. The problem appears to be that too many people aren’t allowing the truth to get in the way of motivation of party mouth pieces. As one pundit says “Why let truth get in the way of a good story?” Steering problems abound!"

Read entire article here: The Art of Political Navigation

Read entire article here: The Art of Political Navigation

"Bic for Her" ballpoint pens: The Commentary

- This review is from BIC For Her Amber Medium Ballpoint Pen (Box of 12) - Black (Office Product): "But they really need more sparkles. And if only the ink was more feminine. maybe pink or purple or even pale green. And maybe the ink could sparkle too? So I'd feel like a princess when I write? But really, whatever the men at Bic think is best. I'm sure they know what I need."

- This review is from BIC For Her Amber Medium Ballpoint Pen (Box of 12) - Black (Office Product): "I tried these on a whim, and I have to say I wasn't very impressed. The applicator mechanism is far too fiddly, and the plastic tampon inside far too thin (not to mention uncomfortable and non-absorbent) - I'm sure there must be a knack to using them, but I couldn't find it. They also stained my knickers blue for some reason. I really wanted to like these, but it's back to pads for me."

- This review is from BIC For Her Amber Medium Ballpoint Pen (Box of 12) - Black (Office Product): "Thank goodness someone has finally noticed that for years, women have

struggled with pen usage. What is the point of being allowed to vote,

when ordinary pens have been just far too uncomfortable and downright

heavy, to grasp in our teeny tiny, porcelain hands? So imagine my

delight when I finally learned that my days of trying to prop up my

ordinary, non-gendered BIC biro with both hands were numbered (although I

couldn't tell you exactly how many numbers, since my grasp of figures,

much like my grasp of pens, is tenuous at best).

I like the retractable bit, as I can now just stare at the end of the pen and watch it appear and disappear whenever I press the clickety-click thing. It's just like magic! However do you do it you clever people?? Anyway, setting myself challenges keeps my pretty little brain honed and ready for when the big questions arise, like whether pink and purple match my skin tone, and how to co-ordinate all that with a decent pair of heels.

However, I do have a couple of quibbles - the medium point is alarmingly unfeminine and it should really be fine point, as no one likes thick handwriting. Perhaps I should have noticed this in the product description, but my eyes must have glazed over at the words "Technical Details". The other thing is why does it come in a box of 12? 10 would be much easier to count to and keep track of!

Last, but not least, it would be a shame to revolutionize the world of pens without tackling the most pressing issue of all - the ink. After such work on the attractiveness of the barrel - we still get plain old black or blue ink at the end! Whyyyy? A mid-lilac would pick up the tones of pink/purple nicely, and our pretty handwriting would then brighten up any office document, or memo. For that reason, 3 out of 5."

See more AWESOME reviews here!

Monday, September 3, 2012

Artists Against Fracking

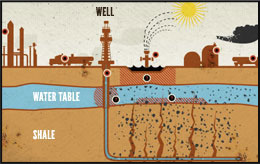

What Is Fracking?

Hydraulic fracturing, aka "fracking," is a new method of extracting gas and oil from rocks at a depth of 2,000 to 10,000 feet down into the shale (soft, sedimentary rock formed from consolidated mud or clay) where one finds natural gas.First, deep wells are drilled straight down through the aquifer (the mixture of soil and water from which life-sustaining water is extracted). This drilling then curves horizontally below the earth's surface and into its shale rock formations. Next, millions of gallons of water laced with chemicals are injected at enormous pressure into these rock formations, breaking apart the rock and freeing trapped methane along with other dangerous materials.

Why Is Fracking Dangerous?

- Aquifer - To drill down to the shale, one must drill through the aquifer. These drills are known to leak and sometimes even explode, releasing chemicals into this precious source of water.

- Chemicals - The 2011 U.S. House of Representatives

investigative report states that out of 2,500 hydraulic fracturing

products, more than 650 contain chemicals that are known carcinogens.

One would think that the Safe Drinking Water Act - a Federal law - would

make such willful contamination illegal, but it is not being applied to

Fracking. Also, most of these chemicals are not biodegradable. Once they are introduced to the aquifer, they will remain there forever.

- Wastewater - Each gas well requires 1-8 million gallons of

fresh water. The used water is one of the most hazardous wastes in the

U.S., containing carcinogenic Fracking chemicals,remnant oil and

hydrocarbons, biocides, as well as naturally occurring radioactive

materials, like radon, which is heavier than air and sinks into the

communities where people work and live.

- Air Pollution - There are air emissions associated with Fracking, which include methane leaks originating from wells, as well as emissions from the diesel or natural gas-powered equipment such as compressors, drilling rigs, pumps etc..

Learn More

(Source: Gasland)

Has Fracking Been Banned Anywhere?

Yes, in Vermont. Governor Peter Shumlin and legislature made Vermont the first U.S. state to ban Fracking. New Jersey, which lacks the pockets of natural gas that one finds in Pennsylvania, Texas, and New York has banned the treatment of Fracking wastewater. It has also been banned in France, Bulgaria, and South Africa.How Can They Do This? Isn't This Against The Safe Drinking Water Act?

The Safe Drinking Water Act (SDWA) is the principal federal law in the United States intended to ensure safe drinking water for the public. In 2005, the Bush/Cheney Energy Bill exempted natural gas drilling from the SDWA. It also exempts companies from disclosing the chemicals used during hydraulic fracturing.For more information and to take further action:

Bailed-out banks facilitate $21 trillion in offshore cash hoard

July 23rd, 2012 | by

Nick Mathiason

|

Hidden treasure: the Cayman Islands where the super-rich hide their cash. (www.shutterstock.com)

|

Investigative economist James Henry exhaustively

trawled through financial information held by the IMF, World Bank, Bank

for International Settlements, central banks and national treasuries to

come up with the most definitive report ever written on the super-rich

and offshore wealth.

- between $21 trillion and $32 trillion of financial assets is owned by High Net Worth Individuals in tax havens. This does not include real estate, art or jewels.

- a conservative 3% return on that $21tn taxed at 30% would generate $189bn – a figure easily eclipsing what OECD industrialised nations spend on overseas development aid.

- the top 50 private banks collectively managed more than $12.1tn in cross-border invested assets for private clients, including their trusts. This is up from $5.4tn in 2005.

- fewer than 10 million members of the global super-rich have amassed a $21tn offshore fortune. Of these, less than 100,000 people worldwide own $9.8tn of wealth held offshore.

Accompanying the Price of Offshore Revisited is a separate paper [co-written by this author]. It reveals that data used by individual countries to assess the gap between rich and poor is inaccurate. And as a result, inequality is far more extreme than policymakers realise.

This is because economists calculating inequality fail to include the vast majority of offshore cash in their findings. So the wealthy are far better off than the studies suggest.

In Inequality: you don’t know the half of it, eight of the world’s leading economists were asked whether offshore wealth was largely excluded from inequality studies. Ranging from the World Bank’s acting chief economist to academics at the Paris School of Economics and the Brookings Institute in the US, they all confirmed this was the case.

This is because the wealthy do not disclose their true incomes. They also rarely participate in surveys. Academics do compensate for non-particpation but they admit, official data vastly underestimates the true picture.

Trickle up

Combined, the two papers published by TJN end any notion that trickle down economics – the Thatcher/Reagan doctrine that suggests tax breaks for the rich benefits all society – works.

We already know that in the US between 1980 and 2010, incomes of the top 1% doubled and the top 0.1% tripled while the bottom 90% saw their incomes fall 5%. But the TJN studies show this wealth disparity would be statistically even worse if offshore cash is included in official studies.

Perhaps most tellingly, the reports bring into sharp focus how global banks – so-called ‘pirate banks’ – have enabled the super-rich to avoid unimaginable sums of tax while at the same time enjoying taxpayers cash through government bank bailouts. A true double whammy of dark proportions.

Some of these banks have been labelled ‘too big to fail’ following the financial crisis. But after the Libor scandal, HSBC’s key role in laundering Mexican drug cash and the subprime bank disaster, there is compelling evidence to suggest they are also ‘too big to be true’.

Which brings us to an issue that is fast troubling global financial regulators: the so-called ‘London disease’. It has not gone unnoticed that many of the financial scandals in recent years have a Square Mile connection.

Never mind Libor, it was the London offices of AIG, Lehman Brothers and Bernie Madoff that helped destroy them. The JP Morgan and UBS rogue traders who lost billions were both London based.

The UK is also arguably the centre of the offshore world. It is one of the biggest private bank centres and Britain’s non-domicile tax rules allow the global super-rich to legally avoid taxes on their overseas income while residing here. In addition, many of the UK’s overseas territories and crown dependencies such as Jersey, Isle of Man, the Cayman Islands and the British Virgin Islands are major offshore centres. This perhaps explains why the British government, for all its rhetoric, has failed to clamp down on the shadow financial system.

It has taken the painstaking work of TJN’s Henry to bring to light the true price of offshore. That the IMF, World Bank or OECD has not done this work is troubling especially as their lack of effective oversight contributed to the economic crisis that has caused significant hardship for hundreds of millions of people.

A good way to atone is to start deploying their thousands of economists to implement measures that will introduce transparency to the financial system instead of policies that facilitate secret offshore hoarding by a tiny elite.

Henry’s Price of Offshore Revisted report, commissioned by Tax Justice Network, shows:

- between $21 trillion and $32 trillion of financial assets is owned by High Net Worth Individuals in tax havens. This does not include real estate, art or jewels.

- a conservative 3% return on that $21tn taxed at 30% would generate $189bn – a figure easily eclipsing what OECD industrialised nations spend on overseas development aid.

- the top 50 private banks collectively managed more than $12.1tn in cross-border invested assets for private clients, including their trusts. This is up from $5.4tn in 2005.

- fewer than 10 million members of the global super-rich have amassed a $21tn offshore fortune. Of these, less than 100,000 people worldwide own $9.8tn of wealth held offshore.

Accompanying the Price of Offshore Revisited is a separate paper [co-written by this author]. It reveals that data used by individual countries to assess the gap between rich and poor is inaccurate. And as a result, inequality is far more extreme than policymakers realise.

This is because economists calculating inequality fail to include the vast majority of offshore cash in their findings. So the wealthy are far better off than the studies suggest.

In Inequality: you don’t know the half of it, eight of the world’s leading economists were asked whether offshore wealth was largely excluded from inequality studies. Ranging from the World Bank’s acting chief economist to academics at the Paris School of Economics and the Brookings Institute in the US, they all confirmed this was the case.

This is because the wealthy do not disclose their true incomes. They also rarely participate in surveys. Academics do compensate for non-particpation but they admit, official data vastly underestimates the true picture.

Trickle up

Combined, the two papers published by TJN end any notion that trickle down economics – the Thatcher/Reagan doctrine that suggests tax breaks for the rich benefits all society – works.

We already know that in the US between 1980 and 2010, incomes of the top 1% doubled and the top 0.1% tripled while the bottom 90% saw their incomes fall 5%. But the TJN studies show this wealth disparity would be statistically even worse if offshore cash is included in official studies.

Perhaps most tellingly, the reports bring into sharp focus how global banks – so-called ‘pirate banks’ – have enabled the super-rich to avoid unimaginable sums of tax while at the same time enjoying taxpayers cash through government bank bailouts. A true double whammy of dark proportions.

Some of these banks have been labelled ‘too big to fail’ following the financial crisis. But after the Libor scandal, HSBC’s key role in laundering Mexican drug cash and the subprime bank disaster, there is compelling evidence to suggest they are also ‘too big to be true’.

Which brings us to an issue that is fast troubling global financial regulators: the so-called ‘London disease’. It has not gone unnoticed that many of the financial scandals in recent years have a Square Mile connection.

Never mind Libor, it was the London offices of AIG, Lehman Brothers and Bernie Madoff that helped destroy them. The JP Morgan and UBS rogue traders who lost billions were both London based.

The UK is also arguably the centre of the offshore world. It is one of the biggest private bank centres and Britain’s non-domicile tax rules allow the global super-rich to legally avoid taxes on their overseas income while residing here. In addition, many of the UK’s overseas territories and crown dependencies such as Jersey, Isle of Man, the Cayman Islands and the British Virgin Islands are major offshore centres. This perhaps explains why the British government, for all its rhetoric, has failed to clamp down on the shadow financial system.

It has taken the painstaking work of TJN’s Henry to bring to light the true price of offshore. That the IMF, World Bank or OECD has not done this work is troubling especially as their lack of effective oversight contributed to the economic crisis that has caused significant hardship for hundreds of millions of people.

A good way to atone is to start deploying their thousands of economists to implement measures that will introduce transparency to the financial system instead of policies that facilitate secret offshore hoarding by a tiny elite.

Labels:

bailout,

bank,

Cayman,

economy,

IMF,

inequality,

justice,

offshore,

Price of Offshore Revisited,

rich,

super-rich,

Tax Justice Network,

taxes,

trickle down,

trillion,

world,

World Bank

Subscribe to:

Posts (Atom)